The landscape of cannabis consumption across the United States has transformed radically over the last decade, especially as states like New York have transitioned from prohibition to regulated recreational markets. In this sweeping change, consumption patterns have become a window into culture, policy, and urban identity. Among the cities competing for the crown, one locale consistently ranks atop not just the state or country but the globe for its cannabis consumption: New York City.

This article delves deeply into the story behind New York’s dominance, unpacks the numbers and demographics, explores the implications for public health and policy, and spotlights how legalization is changing the city’s relationship with cannabis. With data, facts, and fresh perspectives, get ready for a comprehensive journey into the cannabis capital of New York State.

The Evolution of Weed Laws in New York

From Prohibition to Legalization

For decades, New York’s approach to cannabis mirrored that of much of the U.S.—rooted in prohibition, strict enforcement, and significant criminal penalties. Slowly, this stance softened. Medical marijuana was legalized in 2016, opening regulated channels for cannabis access. It wasn’t until March 2021 that New York fully legalized recreational cannabis for adults, joining the wave of states redefining drug policy and opening the doors to a booming legal marketplace.

What the Law Looks Like Today

-

Adults 21 and over may possess up to three ounces of cannabis and up to 24 grams of concentrated cannabis for personal use.

-

Public consumption is largely treated like tobacco smoking, with similar restrictions.

-

Licensed dispensaries are progressively opening throughout New York City and other regions.

Why New York City Tops the Cannabis Charts

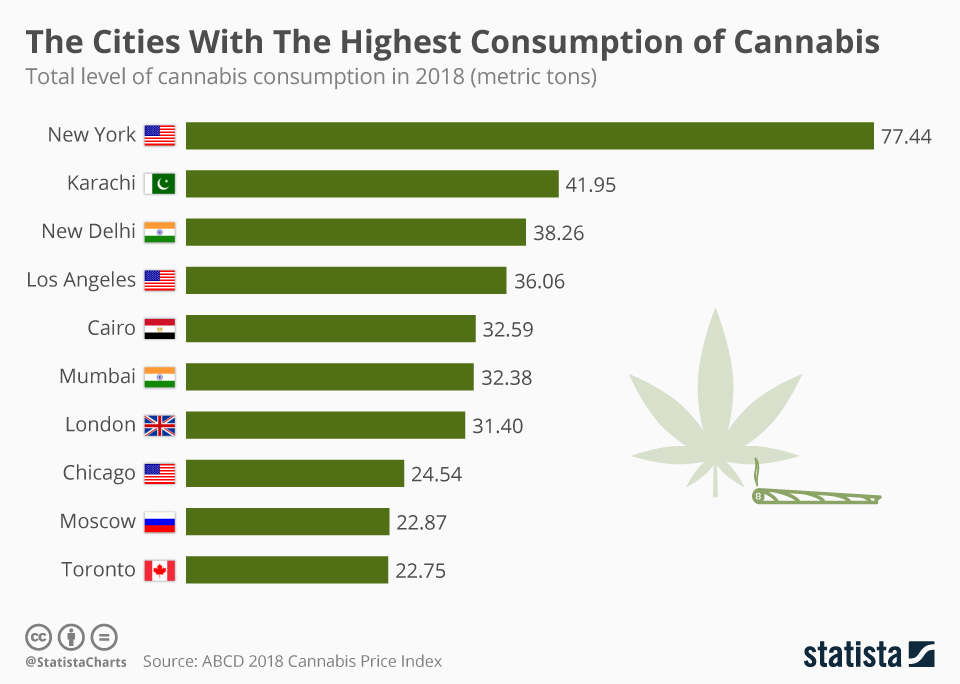

Global Cannabis Consumption Leader

Despite competition from renowned cannabis-friendly cities like Amsterdam, Vancouver, and Los Angeles, New York City reigns supreme both domestically and internationally in total cannabis consumed annually. Studies and market reports consistently estimate that the city’s residents and visitors combined use between 62 and 77 metric tons of cannabis each year. To put this in perspective, this number is nearly double the consumption in Karachi, Pakistan, and significantly higher than other U.S. cities such as Los Angeles and Chicago.

Population and Cultural Impact

Several factors combine to drive this remarkable consumption:

-

Sheer population density: With over 8.3 million residents and millions more visiting annually, the absolute number of potential consumers is enormous.

-

Diverse, open-minded cannabis culture: New York City is a melting pot of backgrounds and attitudes, contributing to an environment where cannabis use is increasingly normalized.

-

Nightlife and creative industries: The entertainment, arts, and hospitality sectors often integrate cannabis into social life and creative pursuits.

-

Historical context: As far back as the jazz age and Beat Generation, New York has played a pivotal role in the evolving American marijuana narrative.

Breakdown of Cannabis Use in Major Cities of New York State

| City | Estimated Cannabis Consumption (Metric Tons/year) | Population Estimate (2024) | Traits and Trends |

|---|---|---|---|

| New York City | 62–77 | 8.3 million | Highest in the world |

| Buffalo | Approx. 3–4 | 276,000 | Growing consumption post-legalization |

| Rochester | Approx. 2–3 | 209,000 | Steady rise, strong local legislative push |

| Syracuse | Approx. 1–2 | 148,000 | Slow but growing cannabis sector |

| Albany | <1 | 100,000 | Rising with increased access |

| Yonkers | <1 | 210,000 | Younger demographics seeing uptick |

While all major cities show consistent growth in cannabis use, none approach the sheer quantity consumed within New York City.

Who Is Consuming in New York City?

By Age

-

Adults ages 21–24 have the highest usage rates, reflecting national trends where younger adults lead in cannabis experimentation and regular use.

-

Thirty-four percent of city adults ages 18–25 report cannabis use within a year.

-

Usage steadily drops off with increasing age groups, but remains significant into middle adulthood.

By Gender

-

Men are more likely to use cannabis than women, but the gender gap has narrowed in recent years.

-

Within New York City, about 19% of men and 13% of women reported cannabis use during recent surveys.

By Race and Ethnicity

-

White New Yorkers report cannabis use at the highest rates (around 24%).

-

Black and Latino populations follow at approximately 14% and 12%, respectively.

-

Diverse neighborhoods and cultural norms shape these usage patterns.

Mode of Consumption

The most common method remains smoking—rolled joints, blunts, and bongs are ever-present. However, edibles and vaporizing devices are rapidly increasing in popularity, reflecting both national trends and changing product availability.

Neighborhoods Leading Consumption within New York City

With five boroughs—Manhattan, Brooklyn, Queens, The Bronx, and Staten Island—New York City displays immense diversity in cannabis culture.

-

The Bronx: Often leads in rates of cannabis-related hospital visits.

-

Brooklyn and Manhattan: Are cultural trendsetters, home to many dispensaries, pop-up cannabis events, and social clubs. The creative and nightlife scenes are especially vibrant here.

-

Queens and Staten Island: See slightly lower, but still significant, rates of cannabis use, often mirroring the broader city average.

The gray market—unlicensed storefronts and delivery services—continues to thrive, especially in areas with slower legal rollout.

The Legal Market and Its Challenges

Dispensary Roll-Out and Licensing

Although New York State has issued approximately 500 retail licenses, delays in legal dispensary openings continue to frustrate both business owners and consumers. As of mid-2025, only a fraction of these licensees have operational storefronts. Financial, regulatory, and zoning issues, as well as competition from a well-established unlicensed market, have hampered the transition to a regulated industry.

The Shadow of the Illegal Market

Unlicensed shops and delivery services vastly outnumber legal cannabis retailers. Estimates suggest that unlicensed vendors outnumber licensed operators more than ten to one, particularly in busy Manhattan neighborhoods and across Brooklyn.

The city and state have stepped up enforcement, closing hundreds of illegal shops and seizing tens of millions of dollars worth of unregulated products. However, demand remains high, and consumers often turn to familiar sources, especially as legal prices remain higher due to taxes and overhead costs.

Economic and Social Impact in New York City

Tax Revenue Potential

If fully transitioned to a legal market, New York City’s cannabis consumption could generate over $150 million annually in tax revenue. Local officials foresee this windfall funding essential public services, such as education, health initiatives, and community-based restorative justice programs.

Employment and Small Business Growth

As the market matures, hundreds of new businesses and thousands of jobs are being created. From dispensaries and cultivation facilities to delivery and hospitality, cannabis is rapidly becoming an important economic pillar for New York City.

Public Health and Consumption Trends

Health officials note positive and negative impacts. On the one hand, legalization allows for safer, regulated products and better-informed consumers. On the other, there is continued concern about daily or near-daily use, especially among young adults and the risks of impaired driving or accidental exposure in multi-generational households.

Social Equity and Community Restoration

One of the hallmarks of New York’s legalization effort is its emphasis on social equity. The state and city have prioritized license applications from individuals adversely affected by past cannabis prohibition, focusing on communities with high historical arrest rates and economic disadvantage. Expungement of cannabis-related criminal records is another crucial component of the new era.

Cannabis Consumption Compared: New York City vs. Other Global Cities

| City | Cannabis Consumption (Metric Tons/year) | Global Rank |

|---|---|---|

| New York City | 62–77 | 1 |

| Karachi | 42 | 2 |

| New Delhi | 38 | 3 |

| Los Angeles | 35 | 4 |

| Cairo | 32 | 5 |

This comparison underscores how the scale of cannabis consumption in New York City dwarfs that of every other city worldwide. In economic, cultural, and public health terms, NYC stands apart.

Cannabis and the New Urban Lifestyle

Nightlife Transformation

Cannabis social lounges, yoga studios, and culinary events centering around edibles have become increasingly common in the city. Traditional nightlife districts—SoHo, Williamsburg, Greenwich Village—now host cannabis-friendly spaces alongside legendary bars and music venues.

Art, Music, and Media

Creative communities have long drawn inspiration from cannabis—and legalization has brought this relationship further into the open. Art shows, music events, and even film screenings now partner with cannabis brands, making the plant central to city cultural life.

Cannabis Tourism

With the city’s reputation as a cannabis capital on the rise, “weed tourism” is now a growing trend. Visitors come to experience New York’s dispensaries, cannabis tours, and unique fusion events pairing local food, art, and cannabis experiences.

The Future: Ongoing Challenges and Emerging Trends

Public Consumption and Regulation

As cannabis becomes more entrenched in daily life, policymakers debate the boundaries of public consumption. Should designated outdoor smoking areas be established? How can vulnerable populations, like children, be protected from secondhand smoke and accidental exposure? These debates continue to shape both city ordinances and public health campaigns.

Education and Responsible Use

State and city departments now launch regular campaigns promoting safe consumption, preventing impaired driving, and educating residents about dosage and product safety. Programs focus particularly on young adults and parents, supporting responsible decision-making and healthy communities.

Emerging Product Trends

Cannabis-friendly beverages, gourmet edibles, and new methods of low-dose, socially friendly consumption are rapidly growing in popularity. Dispensaries and brands that can pivot to serve these changing preferences are poised for success.

Beyond New York City: Other Notable Cities and Regional Trends

While no other city in the state comes close to New York City’s levels, cities like Buffalo, Rochester, and Albany are seeing rapid increases in cannabis consumption, particularly as legal access improves and stigma lessens. Buffalo, with its growing young professional population, is quickly establishing itself as an up-and-coming cannabis hub in western New York. Rochester mirrors this trend, with strong advocacy from community groups and a steady rise in dispensary openings.

Conclusion

New York City holds the undisputed title of cannabis capital—not just of the state, but of the world. Factors as diverse as population size, dynamic culture, progressive legislation, and economic opportunity make the city’s relationship with cannabis unique. As the legal market matures and social equity efforts take root, New York is poised to serve as both a test case and a trendsetter, shaping the future of urban cannabis consumption worldwide.

From Harlem to Coney Island, from the Bronx’s vibrant street life to Brooklyn’s bohemian enclaves, cannabis is becoming a normalized part of New York City living. The journey from prohibition to global leader offers lessons in regulation, entrepreneurship, and community resilience.